Please Share your Email if you Wish to Receive the Golden Tips & Tales Newsletter from History of Ceylon Tea Website

Sri Lanka's tea industry had a rough year in 2022, with substantially lower production and a sharp fall in exports.

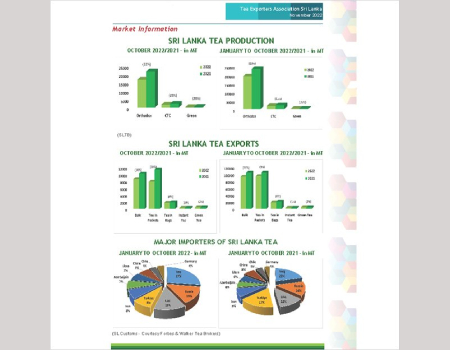

Output for the 10 months through October was at 211 million kilograms, well below the amount for the same period in earlier years. The year's total will fall well short of the 300 million kilograms harvested in 2021.

Export volumes were down 90% during the first ten months, according to Anil Cooke, managing director of Asia Siyaka Commodities. Sri Lanka is the world's largest producer of orthodox black tea, but it lost market share to growers in Vietnam and India.

Repercussions of Russia's invasion of Ukraine had a major impact on exports, since those countries are two of Sri Lanka’s best customers for bulk and orthodox teas. Russia purchased 20 million kilograms, down by 2 million kilograms or 9% from the same period in 2021. Ukraine bought 4.2 million kilos in 2021 but virtually nothing in 2022.

Orders from Japan dropped by 40–45%, according to Cooke. He told the Sunday Times that Japan buys the highest-priced Ceylon teas, so these purchases have a high impact on sales in value terms. Sales to Turkey fell by 55% to 12 million kilograms through October.

Higher sales to Iraq, the UAE, and Poland have helped take up slack in volume terms. Statistics compiled by Forbes and Walker Tea Brokers show an increase of 6 million kilograms shipped to Iraq, up 16% compared to 2021, and 1 million additional kilograms to UAE.

Prices were up. Export prices in October set a record, for the first time averaging more than 2,000 rupees per kilogram. The FOB (Freight on Board) value averaged Rs2,077 in October, an increase over the previous record of Rs1,981 rupees per kilo set in September, as calculated by the Tea Exporters Association of Sri Lanka.

On the other hand, depreciation of the rupee against the US dollar meant buyers could meet their volume demand while paying less. This factor contributed to a tea export value decline of $44 million to $1.064 billion during January–October, compared to $1.108 million for the same period in 2021.

Five trading partners increased their imports of Sri Lankan tea in value terms compared to 2021. These were Poland, up 15%; Azerbaijan, up 12%; Germany, up 8% and the U.S., up 6%.

Crisis impact

Sri Lanka's epochal economic crisis had a major impact on the tea sector in 2022. High inflation made fertilizer, other agricultural inputs, and fuel scarce and more expensive, dragging on production and logistics. Frequent outages of electrical power hampered factory operations in 2022.

Sri Lanka’s economy contracted by an estimated 9.2% in 2022 and will decline by an additional 4.2% in 2023, according to at least one forecast.

Protests during the first six months of 2022 led to the resignation of three prime ministers and the country’s president. In May, Sri Lanka defaulted on $51 billion in foreign debt, triggering food inflation that averaged 81% in 2022, with prices for fuel, cooking gas, medicine, and other essentials inflated by 61% in November, according to the Colombo Consumer Price Index.

But the tea sector is now recovering. Production is forecast to rebound this year, helping earn much needed foreign currency and stabilizing the economy in 2023.

Source: https://stir-tea-coffee.com/tea-coffee-news/sri-lanka-s-tea-industry-had-a-difficult-2022/

Comments

(In keeping with the objectives of this website, all COMMENTS must be made in the spirit of contributing to the history of this estate, planter or person i.e. names, dates & anecdotes. Critical evaluations or adverse comments of any sort are not acceptable and will be deleted without notice – read full Comments Policy here)